Flat Removals

Flat Removals Streatham by Man and Van Streatham

Moving from a flat is very different to moving from a house. Tight stairwells, lifts, parking restrictions and building rules all add pressure. At Man and Van Streatham, we specialise in flat removals in Streatham, handling all the awkward access and logistics so you don’t have to.

Specialist Flat Removals in Streatham

Our service is built around the realities of flat living in Streatham and surrounding areas. Whether you are on the ground floor or the top floor with no lift, our professional team plans your move carefully, protecting your belongings and your building at every stage.

We work with building managers, arrange parking where needed and schedule moves to suit access times. The result is a smooth, calm move that keeps neighbours, concierges and landlords happy.

Who Our Flat Removals Service Is For

Homeowners

If you own a flat in Streatham and are moving on, we provide a full, low-stress moving service. From careful packing of high-value items to dismantling and reassembling furniture, we treat your property as if it were our own, with fully insured cover throughout the move.

Renters

We understand the pressures of end-of-tenancy dates, inventories and deposit returns. Our team protects walls, doors and communal areas to avoid damage claims, and we can coordinate with cleaners or inventory clerks to keep everything on schedule.

Landlords & Letting Agents

We regularly help landlords and agents with flat clearances, part-moves and furniture changes between tenancies. We work tidily, respect building rules and can remove old furniture for disposal or recycling as agreed.

Businesses

Many small businesses operate from flats or small offices above shops in Streatham. We handle office and studio moves, transporting IT equipment, stock and furniture securely and efficiently, minimising downtime.

Students

For students moving to or from Streatham, we offer cost-effective student flat removals. Shared moves, small loads and term-time relocations are all handled with the same care as a full household move.

What We Can and Can’t Move

Items Normally Included

Our flat removals service typically includes:

- Household furniture – beds, wardrobes, sofas, tables, chairs

- White goods – fridges, freezers, washing machines, tumble dryers

- Electronics – TVs, computers, sound systems, gaming equipment

- Personal items – clothes, books, kitchenware, ornaments

- Office items – desks, filing cabinets, printers, boxed archives

- Bicycles, sports equipment and small garden items (for balconies)

Items We Cannot Move

For safety and legal reasons, certain items are excluded from our standard service:

- Hazardous materials – gas bottles, petrol, solvents, paint thinners

- Illegal items or goods of uncertain ownership

- Unsealed liquids in large quantities

- Live animals (we can recommend specialist pet carriers)

- Professional-grade safes or industrial machinery without prior agreement

If you are unsure about a particular item, mention it during your enquiry and we will advise or arrange a suitable solution.

Our Flat Removals Process

1. Enquiry & Quote

You can contact Man and Van Streatham by phone, email or online form. We will ask a few key questions about your flat, access (lifts, stairs, parking), the size of your move and your dates. Based on this, we provide a clear, no-obligation quote explaining what is included.

2. Survey – Virtual or Onsite

For most flat moves, we carry out a short video or phone survey. For larger or more complex properties, we can visit in person. This allows us to assess access, estimate the volume accurately and plan the right size vehicle and team, reducing the risk of surprises on the day.

3. Packing & Preparation

We offer both full packing and part packing services, or you can pack yourself. If you choose our packing service, our trained team brings quality materials and packs your belongings securely, labelling boxes clearly by room. We can also dismantle beds, wardrobes and other large furniture where needed.

4. Loading & Transport

On moving day, we protect floors, bannisters and doors as required. Your items are wrapped and loaded in a logical order to maximise safety and efficiency. Our vehicles are clean, well-equipped and covered by goods in transit insurance, and all driving is carried out by experienced, professional drivers.

5. Unloading & Placement

At your new property, we unload room by room according to your labels and instructions. We place furniture where you need it and can reassemble items we dismantled. Before we leave, we check that everything has been delivered, placed as agreed and that you are satisfied with the move.

Transparent Pricing for Flat Removals in Streatham

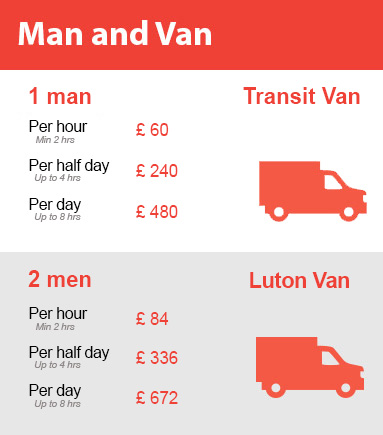

We believe in clear, straightforward pricing. For most flat moves, we work on either:

- A fixed price based on the survey, or

- A competitive hourly rate for smaller or more flexible jobs

Your quote will explain:

- Number of movers and size of vehicle

- Estimated duration or fixed cost

- Any packing materials or packing services included

- Any additional services requested (e.g. disposal, extra drop-off)

There are no hidden extras. Any potential additional costs, such as extended waiting time caused by keys being delayed, are explained clearly in advance.

Why Use Professional Flat Movers Instead of DIY?

Moving flat yourself can seem cheaper, but it often ends up costing more in time, effort and damage. Our trained team moves heavy and awkward items safely through tight spaces, reducing the risk of injury and breakages. We also understand building rules, lift protocols and parking restrictions common in Streatham blocks.

With professional movers, your belongings are protected by goods in transit insurance, and the whole move is planned to a schedule. You avoid last-minute van issues, unreliable helpers and disputes with neighbours or building management.

Insurance and Professional Standards

Man and Van Streatham operates to clear, professional standards so you know your move is in safe hands.

- Goods in transit insurance to protect your belongings while they are in our vehicles

- Public liability cover for peace of mind in shared areas and communal parts of buildings

- Trained moving teams experienced in flat and apartment moves

- Well-maintained, clean vehicles equipped with blankets, straps and trolleys

We follow sensible handling practices, careful lifting techniques and respectful behaviour in shared spaces. Our aim is a smooth move with minimal disruption to you and your neighbours.

Care, Protection and Sustainability

Every move is carried out with care. We use protective covers for furniture and mattresses, and we can use door and floor protection where needed to keep your flat and communal areas clean and undamaged.

Where possible, we reuse sturdy packing materials and recycle cardboard and plastics responsibly. We plan routes to minimise unnecessary mileage and combine smaller loads when appropriate, helping to reduce our environmental impact while keeping standards high.

Real-World Flat Removal Scenarios We Handle

Moving to a New Home

Whether you are upsizing, downsizing or moving in together, we manage full flat-to-flat or flat-to-house moves across Streatham and beyond. We coordinate timings with estate agents and solicitors where needed.

Office or Studio Relocations

Small businesses, therapists, creatives and freelancers often work from flats. We move office furniture, equipment and stock efficiently so you can get back to work quickly in your new space.

Urgent and Short-Notice Moves

Sometimes moves can’t wait. Where our schedule allows, we offer same-day or next-day flat removals in Streatham. We prioritise clear communication, realistic timings and doing the job properly, even when time is tight.

Frequently Asked Questions

How much does a flat removal in Streatham cost?

The cost depends mainly on the size of your flat, the volume of belongings, access (lifts, stairs, parking) and the distance travelled. Smaller studio or one-bed moves may be priced on an hourly rate, while larger two to three-bed flats are usually quoted at a fixed price after a survey. Your quote will clearly show what is included, such as the number of movers, vehicle size and packing options, so you can compare like for like and budget with confidence.

Can you do same-day or urgent flat removals?

Yes, where our schedule allows, we can provide same-day or next-day flat removals in Streatham. Urgent moves are common when tenancy dates change or sales complete at short notice. If you need to move quickly, contact us as early as possible with your details. We will check vehicle and crew availability, give you an honest answer on what we can do, and provide a clear price so you can decide whether it suits your situation.

Are my belongings insured during the move?

Yes. Your goods are covered by our goods in transit insurance while they are in our vehicles, and we also hold public liability cover for work in and around your property. This sits alongside our careful handling, protective equipment and experienced staff. We will explain the key terms and any limits in plain language before your move. If you have particularly high-value items, let us know in advance so we can confirm suitable arrangements or note them specifically.

What is included in your flat removals service?

Our standard service includes loading, transport and unloading of your belongings between properties, with furniture placed in the rooms you specify. We protect items with blankets and straps in the vehicle, and we can dismantle and reassemble basic furniture on request. Optional extras include full or part packing, supply of packing materials and removal of unwanted furniture by prior agreement. Your written quote lists everything included so you know exactly what to expect on moving day.

How is a professional flat removal different from a basic man-and-van?

A casual man-and-van may be fine for a few items, but a full flat move usually needs more planning and protection. With Man and Van Streatham you get a professional, fully insured team, proper equipment, and a structured process from survey to completion. We manage access issues, protect your belongings and communal areas, and allocate the right size vehicle and crew. This reduces the risk of damage, delays and extra journeys, which are common problems with informal services.

How far in advance should I book my flat removal?

Ideally, book as soon as you know your approximate moving date. For peak times such as weekends and month-end, one to three weeks’ notice is recommended to secure your preferred slot. However, we understand dates can shift, especially with sales and tenancy agreements. We try to be as flexible as possible and can often accommodate shorter notice. The earlier you contact us, the easier it is to plan your move smoothly and keep costs down.

Student Removals

Student Removals Streatham – Man and Van Streatham

Starting or finishing university is stressful enough without worrying about how you’ll move your belongings. At Man and Van Streatham, we provide straightforward, student-friendly removals that make moving into or out of halls, shared houses and flats simple, safe and affordable.

Specialist Student Removals in Streatham

Our student removals service is designed around the way students actually live and move. Whether you’re relocating between Streatham, central London or further afield, we offer flexible options to suit tight budgets, shared loads and awkward term dates.

We work across all local halls, private rentals and house shares, and we understand local parking restrictions, building access and landlord requirements. You get a professional, punctual team who handle the lifting, loading and transport, so you can focus on your course and deadlines.

Who Our Student Removals Service Is For

Although this page focuses on students, our service is ideal for a wide range of customers in and around Streatham:

- Homeowners – Downsizing or moving students to and from home during term and holidays.

- Renters – Moving between rented flats or house shares, with minimal disruption and clear communication.

- Landlords – Fast, reliable removals when tenants change, including clearing furniture and appliances.

- Businesses – Moving interns, graduates or staff between accommodation and offices.

- Students – From first-year halls to final-year house shares, Erasmus moves and post-grad relocations.

What’s Included in Our Student Removals

We move most household and study-related items safely and efficiently. Typical items include:

- Suitcases, boxes, books, folders and course materials

- Desks, chairs, shelves and small tables

- Beds, mattresses, wardrobes and drawers (dismantling available on request)

- TVs, laptops, gaming consoles and monitors

- Kitchenware: pots, pans, microwaves, kettles, toasters and small appliances

- Clothing, bedding, bags and personal belongings

- Bicycles and sports equipment

Items We Cannot Move

For safety, legal and insurance reasons, we cannot transport:

- Illegal or stolen goods

- Gas cylinders, fuel, explosives or hazardous chemicals

- Open tins of paint or flammable liquids

- Live animals (including pets and lab animals)

- Perishable food for long-distance moves

- Large industrial machinery or commercial fridges without prior agreement

If you’re unsure whether something can be moved, mention it during the enquiry so we can advise properly.

Our Step-by-Step Student Removals Process

1. Enquiry & Quote

Contact us by phone, email or online form with your dates, locations and a rough list of items. We’ll ask a few clear questions about access (stairs, lifts, parking) and timing. Based on this, we provide a transparent, no-obligation quote with no hidden extras. For students sharing a move, we can split the job by time or volume to keep costs fair.

2. Survey – Virtual or Onsite

For most student moves, a quick virtual survey via photos or video call is enough. For larger flats or shared houses, we can also visit in person if needed. This helps us allocate the right size van, number of movers, and any equipment such as trolleys or mattress covers. A proper survey reduces surprises on the day and keeps your move running smoothly.

3. Packing & Preparation

You can either pack your own belongings or choose our packing service. If you pack yourself, we’ll advise on the best way to protect fragile items and how to label boxes clearly. If we pack for you, our trained team bring quality materials and handle everything from books to electronics with care. We can also dismantle simple furniture ready for loading.

4. Loading & Transport

On moving day, our team arrive on time, introduce themselves and run through the plan. We protect your belongings with blankets, straps and covers, and load the van in a logical, secure order. Everything is transported in our well-maintained vehicles under goods in transit insurance. We drive carefully and keep you updated on progress, especially for longer journeys.

5. Unloading & Placement

At your new address, we unload items into the rooms you specify – not just the front door. We can reassemble basic furniture on request and place larger items where you want them from the start, saving you from heavy lifting later. Before we leave, we’ll check you’re happy with everything and that nothing has been overlooked in the van or property.

Transparent, Student-Friendly Pricing

We know budgets are tight for students, so we keep pricing clear and fair. Typical pricing structures include:

- Hourly rates for local moves within Streatham and nearby areas

- Fixed prices for longer distances or full van loads

- Shared-load options if more than one student is moving on similar routes

Your quote will clearly state what’s included: labour, travel time, fuel, and any additional services such as packing or furniture dismantling. There are no surprise charges on the day. If your requirements change, we’ll discuss revised costs with you before carrying out extra work.

Why Choose Professional Student Removals Over DIY

Hiring a professional removals team may seem like an extra cost, but it often saves money and hassle overall. With a DIY move you may face multiple car trips, congestion charges, parking fines, vehicle hire complications and the risk of damaging your belongings or the property. Our service includes the right-sized van, experienced movers, proper protection materials and insurance cover.

Compared with casual man-and-van adverts, we offer reliability, background-checked staff, punctual arrivals and clear terms. If something goes wrong in a DIY or unregulated move, you often have no comeback. With us, you’re dealing with a properly run removals company that stands behind its work.

Insurance & Professional Standards

Man and Van Streatham operates to high professional standards so you can move with peace of mind:

- Goods in transit insurance – Your belongings are covered while in our care and on the road, subject to policy terms.

- Public liability cover – Protection in the unlikely event of accidental damage to buildings or third parties during the move.

- Trained moving teams – Our staff are properly trained in lifting techniques, packing, securing loads and customer care.

- Clean, well-maintained vehicles – Regularly serviced vans with suitable equipment and protective materials.

We’re used to working in shared buildings, halls of residence and managed apartments, and we respect house rules, quiet hours and neighbours.

Care, Protection and Sustainability

We treat every student move with the same care as a full house relocation. Mattresses and soft furnishings are covered, TVs and monitors are wrapped, and fragile boxes are clearly protected and placed securely. Floors and walls are watched carefully to avoid marks in both your old and new properties.

Where possible, we use reusable covers, blankets and crates to cut down on single-use plastics. We encourage reusing boxes and can collect good-quality materials for future moves. Efficient route planning helps reduce unnecessary mileage and emissions, while still giving you accurate arrival times.

Real-World Student Removal Scenarios

- Moving into first-year halls – One van, one or two movers to get you set up quickly, even on busy arrivals weekends.

- Shared house moves – Coordinated collections from several addresses, then delivery to a new student house with room-by-room unloading.

- End-of-year clear-outs – Moving belongings home or into storage, with timed collections around exam timetables.

- Urgent or last-minute moves – Short-notice support when tenancies change unexpectedly or plans fall through.

- Graduation relocations – Full moves from Streatham to other UK cities for graduates starting new jobs or courses.

Frequently Asked Questions

How much do student removals in Streatham cost?

Costs depend on how much you’re moving, the distance between addresses and access at each property. A small local student move within Streatham is usually priced on an hourly basis, while longer journeys are often quoted as a fixed price. Sharing a move with housemates going in the same direction can reduce the cost per person. Once we know what you’re moving and when, we’ll give you a clear, written quote with labour, fuel and any extras itemised so you can budget confidently.

Can you do same-day or urgent student moves?

Yes, where our schedule allows we can offer same-day or urgent moves in and around Streatham. This is particularly common at the end of tenancies or when plans change unexpectedly. The sooner you contact us, the better chance we have of fitting you in. For urgent jobs, it helps if you have boxes packed and a clear list of items ready. We’ll confirm availability, pricing and timings upfront, so you know exactly what to expect before we set off.

Are my belongings insured during the move?

Yes. Your items are covered by our goods in transit insurance while they are in our vehicle and under our control, subject to policy terms and limits. We also hold public liability cover in case of accidental damage to buildings or third parties. We’ll explain any exclusions, such as certain high-value items or pre-existing damage, during the booking process. You’re welcome to tell us about particularly valuable belongings so we can take additional precautions beyond our usual careful handling and protective packing.

What’s included in your student removals service?

Our standard service includes the van, fuel, a professional driver and at least one experienced mover, plus loading, transport and unloading into your new home. We provide blankets, straps and basic protective materials as standard. Optional extras include packing services, furniture dismantling and reassembly, and additional movers for larger or more complex jobs. All inclusions and any agreed extras are clearly listed in your quote, so you know precisely what is and isn’t covered before moving day.

How is your service different from a basic man-and-van?

While a casual man-and-van might simply turn up with a vehicle, we offer a structured, fully insured removals service. That means proper planning, surveys where needed, written quotes, trained staff, and protection for your belongings and the properties involved. We bring the right equipment, respect building rules, and turn up when we say we will. If something unexpected happens, we have procedures and insurance in place. In short, you’re getting a professional removals company rather than an informal lift with limited accountability.

How far in advance should I book my student move?

For peak times such as the start and end of term, we recommend booking at least two to three weeks in advance to secure your preferred date and time. Outside of these busy periods, a week’s notice is often enough, and we can sometimes accommodate shorter notice. The earlier you contact us, the more flexible we can be with timings and pricing options. Even if your exact dates aren’t confirmed yet, it’s worth getting in touch so we can pencil you in and advise on the next steps.

Furniture Removals

Furniture Removals in Streatham by Man and Van Streatham

At Man and Van Streatham, we provide reliable, carefully planned furniture removals for homes and businesses across Streatham and the surrounding areas. With years of hands-on moving experience, we know how to protect your furniture, your property and your time.

Professional Furniture Removals in Streatham

Our furniture removals service is designed for anyone who needs their items moved safely, efficiently and with minimal disruption. Whether you are moving a single heavy wardrobe or the entire contents of a four-bedroom house, our trained team uses the right techniques, vehicles and protective materials to get the job done properly.

We cover Streatham, Streatham Hill, Streatham Common and neighbouring areas, handling local moves, longer-distance relocations and internal moves within the same building.

Who Our Furniture Removals Service Is For

Our Streatham furniture removals are tailored to:

- Homeowners – Full house moves, downsizing, or rearranging large items between rooms and floors.

- Renters – Flat, maisonette and shared-house moves, including tight staircases and limited parking.

- Landlords – Part-furnished and fully furnished properties, end-of-tenancy clear-outs and replacements.

- Businesses – Office furniture, reception areas, meeting rooms, stockrooms and light commercial items.

- Students – Compact moves of beds, desks, wardrobes and personal furniture between term-time and home.

We adapt the crew size, vehicle and timings to your specific situation, so you only pay for what you actually need.

What We Can and Cannot Move

Furniture and Items We Typically Move

Our removals teams routinely handle:

- Sofas, armchairs and corner units

- Beds, mattresses, wardrobes and chests of drawers

- Dining tables, chairs, sideboards and dressers

- Desks, office chairs, filing cabinets and storage units

- Bookshelves, TV units and coffee tables

- Flat-pack furniture (assembled or disassembled)

- White goods such as fridges, freezers, washing machines and tumble dryers (disconnected)

We also provide specialist handling for fragile or high-value items such as glass tables, mirrors and antiques, using padded covers and extra protection where needed.

Items We Cannot Move or Need to Assess First

For safety, legal or insurance reasons, some items are excluded or require prior agreement:

- Hazardous materials (paint, fuel, chemicals, gas bottles)

- Live animals or plants in bulk

- Very high-value artworks or jewellery (may require a specialist carrier)

- Items permanently fixed to the building or requiring specialist disconnection (e.g. gas cookers not disconnected by a professional)

If you are unsure about a particular item, we are happy to advise during your enquiry or survey.

Our Step-by-Step Furniture Removals Process

1. Enquiry & Quote

Everything starts with a quick conversation. You can call, email or use our online form to tell us what you need moved, where from and where to, and any access details. We will ask a few practical questions to understand the volume, difficulty and timings, then provide a clear, no-obligation quote.

2. Survey – Virtual or Onsite

For larger or more complex moves, we arrange a short survey. This can be done via video call or in person in Streatham. We assess access, parking, staircases, lifts and the size and type of furniture. This helps us allocate the right vehicle, crew size and protective materials, and avoids surprises on moving day.

3. Packing & Preparation

You can choose between:

- Full furniture packing – We bring all materials, dismantle where needed, wrap and protect everything.

- Part packing – We handle the large and fragile furniture; you pack smaller personal items.

- Customer-packed – You pack everything; we focus on safe handling and transport.

We use padded blankets, furniture covers, mattress bags and floor protection to keep both your furniture and property safe.

4. Loading & Transport

On moving day, our professional team arrives on time, walks through the plan with you and starts loading in a logical order. Heavy and bulky items are handled by multiple movers using equipment such as dollies and straps where appropriate. Everything is secured in our vehicles to prevent movement in transit. We then transport your furniture directly to your new address or storage facility.

5. Unloading & Placement

At the destination, we unload carefully and place each item in the room you choose. If dismantling was agreed, we can reassemble basic furniture such as bed frames and tables. Before we leave, we check that you are happy with the placement and condition of your furniture and remove any materials we have brought with us.

Transparent Furniture Removals Pricing

We believe in clear, straightforward pricing with no hidden extras. Our furniture removals in Streatham are typically priced based on:

- Volume and type of furniture

- Number of movers required

- Travel distance and access complexity

- Level of packing and dismantling needed

- Any out-of-hours or weekend requirements

You will receive a written quote detailing what is included, so you know exactly what you are paying for. If your requirements change, we will discuss any price adjustments upfront, not on the day.

Why Choose Professional Furniture Removals Over DIY

Moving furniture yourself or relying on a casual man-and-van can seem cheaper, but often leads to damage, delays or even injury. As a dedicated removals company in Streatham, we bring:

- Trained movers who know safe lifting techniques and how to navigate tight spaces.

- Suitable vehicles with proper securing points and protective equipment.

- Fully insured cover for your items in transit and at properties.

- Efficient planning to minimise disruption to your day.

The result is fewer risks, less stress and a smoother experience from start to finish.

Insurance & Professional Standards

Man and Van Streatham operates to professional moving standards to protect both you and your belongings.

- Goods in transit insurance – Covers your furniture while it is being moved in our vehicles, subject to terms and conditions.

- Public liability cover – Protects against accidental damage to third-party property or injury while we are working.

- Trained moving teams – Our crews are experienced in handling heavy, awkward and fragile furniture properly.

We are happy to explain our insurance cover in plain language and provide details on request.

Care, Protection and Sustainability

We treat your furniture as if it were our own. Our teams use clean blankets, padded covers and floor protection to avoid scuffs, scrapes and dirt. Corners and edges are given extra attention, and we think carefully about the order items are loaded and unloaded to prevent damage.

Where possible, we reuse durable packing materials, minimise unnecessary journeys and plan efficient routes around Streatham and beyond. This not only keeps costs sensible but also reduces our environmental impact.

Real-World Furniture Removals Use Cases

Moving House Within Streatham

Many of our clients are moving between flats and houses around Streatham, dealing with narrow staircases, residents' parking bays and busy roads. We work with you to plan timings, parking suspensions where needed and safe handling of heavier items such as wardrobes and sofas.

Office & Business Relocations

For local businesses, we provide office furniture removals including desks, chairs, filing cabinets and reception areas. We can schedule moves outside normal working hours to reduce downtime, label items for easy placement and liaise with building management where required.

Urgent or Same-Day Furniture Moves

Situations change quickly – a last-minute tenancy change, furniture purchase or urgent clearance. Subject to availability, we can offer same-day or short-notice furniture removals in Streatham. Call us as early as possible, and we will let you know realistic options and timescales.

Frequently Asked Questions

How much do furniture removals in Streatham cost?

The cost depends mainly on how much furniture you have, how difficult access is and the distance between addresses. Smaller jobs, such as moving a few large items locally, are often charged on an hourly rate with a minimum booking period. Larger house or office moves are usually priced as a fixed quote based on a survey. This allows us to include the right number of movers, vehicle size and any packing or dismantling work. We will always provide a clear written price before you commit.

Can you do same-day or urgent furniture removals?

Yes, we can often provide same-day or next-day furniture removals in Streatham, especially for smaller moves or single items. Availability depends on how busy we are and the size of the job, so contacting us as early as possible is important. When you call, we will check our schedule, discuss what needs moving and give you realistic time slots. Even for urgent work, we still follow proper safety and protection procedures – we never cut corners just to rush a job.

Are my belongings insured during the move?

Yes. Your furniture is covered by our goods in transit insurance while it is in our vehicles, and we also hold public liability cover for work at your properties. Insurance is there as a safety net; our main focus is on preventing damage through good packing, careful handling and secure loading. We will outline the key terms, including any limits and exclusions, before you book. If you have particularly high-value or unusual items, please mention them so we can advise on the best approach.

What is included in your furniture removals service?

Our standard service includes a suitable vehicle, a professional moving team, protective blankets and covers, loading, secure transport and unloading into the rooms you choose. We can also add optional services such as packing, dismantling and reassembly of basic furniture, supply of boxes and materials, and storage runs. Your written quote will clearly state what is included so there is no confusion on moving day. If you are unsure whether something is covered, simply ask during the enquiry or survey stage.

How is a professional removals service different from a casual man-and-van?

A casual man-and-van often provides basic transport only, with limited insurance and little planning. As a dedicated removals company, we offer fully insured moves, trained staff, the right equipment and a structured process from survey to placement. We understand how to move heavy and fragile furniture safely, protect your home and keep disruption to a minimum. While the initial price might be slightly higher than a casual service, the reduced risk of damage, delay and stress usually makes professional removals the better value option.

How far in advance should I book my furniture removal?

For most moves, we recommend booking 1–3 weeks in advance, especially if you are moving at busy times such as month-end, Fridays or weekends. This gives us time to arrange surveys, parking and any packing you require. That said, we often accommodate shorter-notice moves in Streatham when our schedule allows. If your dates are not fixed yet, you can still contact us for an estimate and provisional booking, then confirm the exact day once your plans are finalised.

Piano Removals

Piano Removals Streatham – Man and Van Streatham

Moving a piano is not the same as moving ordinary furniture. At Man and Van Streatham, we provide a dedicated piano removals service in Streatham and surrounding areas, using specialist equipment, trained staff and safe handling techniques to protect your instrument and your property.

Specialist Piano Removals in Streatham

Whether you own a family heirloom upright or a concert grand, our team understands the weight, balance and sensitivity of pianos. We plan every move carefully, allowing for stairs, tight corners, flooring types and access. Our vehicles are fitted with professional securing systems to prevent movement in transit, and we use padded covers, piano skates and ramps to minimise any risk of damage.

We work across Streatham and nearby areas, helping customers move pianos between homes, to rehearsal spaces, schools, performance venues and storage facilities.

Who Our Piano Removal Service Is For

Our piano removals service is designed for:

- Homeowners moving house or rearranging rooms

- Renters relocating between flats or houses, including upper floors

- Landlords needing a piano moved in or out of a let property

- Businesses such as bars, restaurants, schools, churches and music studios

- Students at music colleges who need a piano moved to or from accommodation

Whether it is a one-off local move in Streatham or part of a wider house removal, we can integrate piano transport into your overall moving plan.

What We Can and Cannot Move

Items Included in Our Piano Removals

We safely move most types of pianos and related equipment, including:

- Upright pianos (including overstrung and tall uprights)

- Baby grand pianos

- Grand pianos (subject to access and survey)

- Digital pianos and stage pianos

- Piano stools, benches and music cabinets

- Associated accessories such as covers and stands

Items Excluded or by Special Arrangement

To keep you and our team safe, some items are excluded or require prior agreement:

- Pianos requiring crane or hoist access (may be arranged via specialist partners)

- Pianos with severe structural damage that may be unsafe to move

- Hazardous materials or liquids stored inside or on the piano

- Non-removal tasks such as tuning or internal repairs (we can recommend local technicians)

If you are unsure whether your instrument can be moved safely, we will assess it during the survey stage.

Our Step-by-Step Piano Removals Process

1. Enquiry & Quote

Contact Man and Van Streatham by phone or online with basic details: piano type, collection and delivery addresses, floor levels, lift access and any time constraints. We provide a clear, no-obligation quote outlining what is included, any access considerations and the likely duration of the move.

2. Survey (Virtual or Onsite)

For most piano moves, we carry out a professional survey. This may be a video call or an onsite visit, depending on complexity. We measure doorways, staircases and landings, plan routes and identify any risks. This stage allows us to allocate the right number of staff, correct equipment and suitable vehicle.

3. Packing & Preparation

On moving day, our trained team prepares the piano carefully. We protect the instrument with thick pads and covers, secure lids and removable parts, and, for grands, we may remove legs and pedals where necessary. Floors, bannisters and door frames are padded as needed to avoid scuffs or dents to your property.

4. Loading & Transport

Using piano skates, lifting straps, ramps and team coordination, we move the piano safely to our vehicle. Inside the van, the instrument is positioned correctly, strapped to anchor points and cushioned with additional padding. Our fully insured vehicles are maintained to a high standard and driven by experienced drivers used to transporting heavy, delicate items.

5. Unloading & Placement

At the destination, we reverse the process, placing the piano exactly where you want it, subject to safe access. We can offer basic advice on positioning away from heat sources and damp. Once in place, we remove all protective materials and invite you to inspect the instrument and surrounding areas before we leave.

Transparent Pricing for Piano Removals

We believe in clear, straightforward pricing. Piano removal costs in Streatham are typically based on:

- Type and size of piano (upright, baby grand, grand)

- Access difficulty at both properties (stairs, narrow corridors, parking)

- Distance between addresses

- Number of staff required and expected time on site

- Any additional services, such as integration into a full house move

We will always confirm the price before work starts, so you know exactly what to expect. Where access is more complex than described, we discuss any adjustments with you before proceeding.

Why Choose Professional Piano Movers Instead of DIY

Attempting to move a piano yourself or using a casual man-and-van can lead to injuries, damage to the instrument, and damage to your property. Pianos are extremely heavy, unbalanced and fragile inside. Our trained teams understand weight distribution, correct lifting techniques and how to secure the instrument safely.

We use purpose-built equipment, conduct risk assessments and hold appropriate insurance. This careful approach protects not only your piano but also staircases, floors, walls and neighbouring properties. In many cases, using a professional service is more cost-effective than repairing avoidable damage after a DIY attempt.

Insurance and Professional Standards

Man and Van Streatham operates to strict professional standards for all piano removals in Streatham:

- Goods in transit insurance to protect your piano while it is being transported

- Public liability cover for peace of mind on your premises and communal areas

- Trained moving teams experienced with heavy, delicate items

- Risk assessments and methodical planning for complex access

While we handle every instrument with great care, this insurance provides an extra layer of reassurance for valuable or sentimental pianos.

Care, Protection and Sustainability

We treat every piano as if it were our own. Protective materials, careful lifting and calm, steady working all help to minimise risk. Where possible, we use reusable covers, pads and straps rather than single-use plastics, and we plan efficient routes to reduce unnecessary mileage and emissions.

Where pianos are being moved as part of a larger house or office move, we look to consolidate journeys and avoid multiple trips, which is both cost-effective and better for the environment.

Real-World Piano Removal Use Cases

Moving House

Many customers in Streatham ask us to include their piano within a full home removal. We coordinate timings so the piano is loaded and unloaded safely alongside your furniture, ensuring it is one of the first items positioned in your new home so you can plan rooms around it.

Office and Commercial Relocations

We work with schools, churches, event venues, bars and studios to move pianos between premises, rehearsal rooms and performance spaces. Early starts or late finishes can often be arranged to minimise disruption to your operations.

Urgent or Short-Notice Moves

Sometimes a piano has to be moved at short notice – for example, ahead of building works, flooring changes or an unexpected change of tenancy. Subject to availability, we can offer same-day or next-day piano removals in Streatham, always maintaining our usual safety and care standards.

Frequently Asked Questions

How much does a piano removal cost in Streatham?

The cost of a piano removal depends mainly on the type of piano, access at each property and the distance travelled. Upright pianos on ground floors with straightforward access are usually at the lower end of the price range, while grands or moves involving multiple flights of stairs cost more due to the extra staff and time required. After a short discussion and, if needed, a survey, we provide a clear, fixed price so you know exactly what is included before you book.

Can you do same-day or urgent piano removals?

Same-day or urgent piano removals are often possible, especially within Streatham and nearby areas, but depend on existing bookings and staff availability. If you need a piano moved at short notice, contact us as early in the day as you can with full details of the job. We will confirm whether we can help, suggest the earliest available time slot and provide a firm quote. Even for urgent moves, we do not cut corners on safety, surveys or protective measures.

Is my piano insured during the move?

Yes. Your piano is covered by our goods in transit insurance while it is being transported in our vehicle, and our public liability cover protects you against accidental damage to your property during handling. We are always happy to explain the scope and limits of our policies so you understand exactly how you are protected. While insurance is there for peace of mind, our focus is on careful planning, skilled handling and secure loading to prevent any incident in the first place.

What is included in your piano removals service?

Our service includes a pre-move assessment, allocation of a trained team, all standard protection materials, use of piano skates, ramps and straps, loading, secure transport and careful placement at the destination. We protect floors, bannisters and door frames where needed, and we position the piano in your chosen room where it is safe to do so. Tuning and internal repairs are not included, but we can move the piano to your chosen technician or recommend local professionals if required.

How is a professional piano removal different from a basic man-and-van?

A basic man-and-van service typically focuses on general goods and may not have specific training or equipment for heavy, delicate instruments. Our piano removals service uses specialist kit, risk assessments and staff experienced in moving large pianos through challenging spaces. We carry appropriate insurance and follow structured procedures to protect your instrument and property. While prices may be higher than a casual service, the reduced risk of damage and injury usually makes professional piano movers the more sensible choice.

How far in advance should I book a piano removal?

Where possible, we recommend booking at least one to two weeks in advance, particularly if you need a specific date or time, or if your piano move is part of a larger house removal. This allows us to complete a proper survey and allocate the right team. However, we appreciate that this is not always possible, and we regularly help customers on shorter notice. The earlier you contact us, the more flexible we can be with dates and pricing.

Man with Van

Man with Van Streatham – Professional Local Moving Service

At Man and Van Streatham, our man with van service is designed for anyone who needs a reliable, well-organised move without the stress. We combine the flexibility of a traditional man-and-van with the standards of a professional, fully insured removals company, tailored specifically to Streatham and the surrounding areas.

What Our Man with Van Service Includes

Our service is ideal for small to medium moves where you want experienced movers, careful handling and clear communication from start to finish. You get a modern, well-maintained van and a trained mover (or team) who will do the lifting, loading and safe transport of your belongings.

Typical service variations

- Single-item moves – sofas, wardrobes, white goods, bulky furniture

- Flat and small house moves – studio, 1–2 bedroom properties

- Student moves – term-time relocations and end-of-tenancy moves

- Office and small business moves – desks, IT equipment, archive boxes

- Store collections – IKEA, B&Q, furniture stores and marketplace purchases

- Urgent & same-day moves – subject to availability

Every booking includes loading, secure transport, and unloading at your new address, with protective equipment used as required.

Local Expertise in Streatham

We work in Streatham day in, day out. That local knowledge matters when it comes to parking, access, and timing your move around traffic on Streatham High Road, Greyhound Lane, Mitcham Lane and the surrounding residential streets.

We understand the quirks of Victorian terraces, mansion blocks and new-build flats across Streatham Hill, Streatham Common and Streatham Vale. Tight stairwells, controlled parking zones and lift access are all planned for in advance so we can move you efficiently and safely.

Who Our Man with Van Streatham Service Is For

Homeowners

Perfect for smaller house moves, downsizing or moving a selection of larger items before or after your main removal. We protect floors and furniture, and we can coordinate with your main move if needed.

Renters

Whether you’re moving between rented properties or ending a tenancy, our flexible time slots and clear pricing suit tenants who want a smooth move without disturbing neighbours or breaching building rules.

Landlords

We help landlords clear properties, move in furniture for new tenants or remove unwanted items. Discreet, punctual and respectful of building management requirements.

Businesses

Small offices, shops and self-employed professionals use our service for moving stock, equipment and office furniture. We can work outside standard hours to minimise disruption.

Students

Ideal for moving between halls, shared houses and storage. We keep things simple with clear time slots and help with carrying boxes and luggage so you’re not relying on friends with cars.

What We Can and Cannot Move

Items typically included

- Domestic furniture – beds, sofas, wardrobes, tables and chairs

- Appliances – washing machines, fridges, freezers, cookers (disconnected)

- Boxes, bags and suitcases of personal belongings

- Office furniture – desks, filing cabinets, chairs and shelving

- Electronics – TVs, monitors, PCs, printers and audio equipment

- Garage and garden items – tools, bikes, small garden furniture

Items we cannot move

- Hazardous materials (fuel, gas bottles, chemicals, paint thinners)

- Live animals or pets

- Illegal or stolen goods

- Industrial machinery not safely dismantled

- Items exceeding our safe lifting or size limits (we’ll advise during enquiry)

If you are unsure about a specific item, mention it during your enquiry and we will confirm whether it can be moved safely and legally.

Our Step-by-Step Man with Van Process

1. Enquiry & Quote

You contact us with basic details: addresses, dates, property type, floors and a list of main items. Based on this, we provide a clear, no-obligation quotation, usually on an hourly or fixed-price basis depending on the job.

2. Survey – Virtual or Onsite

For straightforward moves, a phone or video survey is usually enough. For larger or more complex moves, we can arrange an onsite visit in Streatham. This helps us assess access, parking, stairs and any fragile or bulky items so we can send the right vehicle and team.

3. Packing & Preparation

You can pack your own boxes, or we can provide professional packing as an additional service. Either way, we offer guidance on labelling, dismantling furniture and preparing appliances. On the day, we bring blankets, straps and trolleys to protect and handle items safely.

4. Loading & Transport

On moving day, we arrive on time, introduce the team and walk through the property with you. We then safely load the van, protecting furniture with blankets and securing everything with straps. Your belongings are transported directly to your new address using efficient routes through Streatham and beyond.

5. Unloading & Placement

At the destination, we unload items into the rooms you specify. We can reassemble basic furniture that we dismantled and position larger pieces where you want them. Before we leave, we ask you to check that everything is in place and you’re satisfied with the service.

Transparent, Fair Pricing

We believe in straightforward, honest pricing. Our man with van service is usually charged either:

- On an hourly rate with a minimum booking period; or

- As a fixed price for clearly defined jobs (for example, a set number of items or specific addresses).

Your quote will confirm:

- How many movers are included

- The size of van we’ll use

- What is and isn’t included (for example, packing or dismantling)

- Any parking or congestion-related charges if applicable

There are no hidden extras: any potential additional costs, such as extended waiting times caused by key delays, are explained clearly in advance.

Why Choose a Professional Man with Van Instead of DIY

Hiring a professional man with van in Streatham means more than just getting a vehicle. You benefit from trained movers who understand safe lifting techniques, correct loading patterns and how to protect carpets, walls and furniture. This reduces the risk of damage or injury compared with doing it yourself or using an unregulated casual service.

We are fully insured, operate maintained vehicles and follow industry-standard procedures. You save time, avoid physical strain and have someone accountable for the safe handling of your belongings.

Insurance and Professional Standards

Your belongings are important, and we treat them that way. Our service includes:

- Goods in transit insurance – covering your items while they are in our vehicle

- Public liability cover – protecting you and your property during the move

- Trained moving teams – staff experienced in handling fragile, heavy and awkward items

We follow clear procedures for wrapping, loading and unloading to minimise risk. In the unlikely event that something goes wrong, you have the reassurance of working with a properly insured, accountable company rather than an informal operator.

Care, Protection and Sustainability

We focus on careful handling from start to finish. Furniture is covered with moving blankets, mattresses are wrapped, and we use trolleys to prevent dragging across floors. Where needed, we protect doorways and banisters to avoid scuffs in communal areas.

We are also mindful of our environmental impact. We plan routes efficiently, maintain our vehicles for better fuel efficiency and, where possible, reuse durable packing materials such as blankets and crates. If you have unwanted items, we can signpost you to local reuse or recycling options in and around Streatham.

Real-World Examples of How We Help

Moving House in Streatham

For smaller homes and flats, our man with van service can handle the full move in one or two trips. We often help couples moving between flats in Streatham Hill or families moving closer to local schools. We manage parking, access and timing to fit around your schedule.

Office and Business Relocations

We work with local businesses upgrading or downsizing offices, moving stock to storage or relocating to new premises. Moves can be scheduled early morning, evening or at weekends to minimise downtime, with extra care taken over IT and sensitive documents.

Urgent and Same-Day Moves

Last-minute move-out notices, short completion times and urgent furniture deliveries are common. Subject to availability, we can arrange same-day or next-day man with van support in Streatham, giving you a reliable solution when time is tight.

Frequently Asked Questions

How much does a man with van in Streatham cost?

Costs depend on how much you’re moving, the distance between addresses, access (floors, lifts, parking) and how many movers are needed. Smaller local moves are often charged at an hourly rate with a minimum booking period, while clearly defined jobs can be priced as a fixed fee. To give an accurate quote, we’ll ask for a list of key items, postcodes and any access details. There are no hidden extras – all charges are explained before you confirm your booking.

Can you offer same-day or urgent man with van bookings?

Yes, in many cases we can provide same-day or short-notice man with van services in Streatham, especially for local moves or single-item jobs. Availability depends on how busy we are and the size of move required, so it’s always best to call as early as possible. If we can’t offer the exact time you want, we’ll suggest the nearest available slot and explain how long the job is likely to take so you can plan around it.

Are my belongings insured during the move?

Yes. Your items are covered by our goods in transit insurance while they are in our vehicle, and we also hold public liability cover for work at your property. This is designed to provide protection in the unlikely event of accidental damage or loss. We’ll outline the key points of our cover when you book, including any limits or exclusions. For particularly high-value items, you can let us know in advance so we can advise on any additional precautions or documentation.

What’s included in your man with van service?

Our standard service includes a suitable van, at least one trained mover, loading your items from the agreed address, secure transport and unloading into the rooms you choose at your new place. We provide blankets, straps and basic protection as standard. Optional extras, such as packing, dismantling and reassembly, or additional movers, can be added at your request. Parking charges and congestion or emission zone fees may be passed on at cost, but these will always be explained in your quote beforehand.

What’s the difference between your service and a casual man-and-van?

We operate as a professional, fully insured removals company, not as an informal side job. That means trained staff, maintained vehicles, documented bookings and proper insurance. We plan access, use appropriate equipment and follow safe lifting and loading practices. With a casual operator, you may not have clear terms, adequate cover or reliable timekeeping. Our approach is designed to give you peace of mind, predictable costs and accountability from the first enquiry through to completion.

How far in advance should I book?

For weekend or month-end moves, we recommend booking at least one to two weeks in advance, as these dates are popular. For mid-week and smaller jobs, a few days’ notice is often enough. That said, we regularly accommodate short-notice and next-day moves when our schedule allows. Even if your moving date isn’t confirmed, it’s worth contacting us early so we can pencil you in and discuss options if your plans change.

Same day Removals

Same Day Removals Streatham by Man and Van Streatham

If you need to move today, Man and Van Streatham provides a fast, organised and fully insured same day removals service across Streatham and surrounding areas. As local removals professionals, we handle urgent moves calmly and efficiently, making sure your belongings are packed, protected and transported safely – even at short notice.

What Our Same Day Removals Service Includes

Same day does not mean rushed or careless. We apply the same professional standards to urgent moves as we do to planned relocations. Our trained team arrives with the right vehicle, equipment and packing materials to complete your move in one smooth process.

Typical same day removals in Streatham include:

- Urgent flat and house moves within Streatham and across London

- Last-minute moves due to rental deadlines or contract changes

- Emergency office or shop relocations

- Student moves into or out of halls and shared houses

- Part-load urgent collections and deliveries

Every job is covered by goods in transit insurance and public liability cover, giving you peace of mind even when time is tight.

Local Same Day Removals Expertise in Streatham

Operating from Streatham, we know the local area, traffic patterns and access issues extremely well. That local knowledge matters on a same day move, where delays can cause real problems.

- Familiar with Streatham Hill, Streatham Common, Streatham Vale and surrounding roads

- Experience with controlled parking zones and loading restrictions

- Advice on parking suspensions and access where possible

- Efficient route planning for cross-London same day deliveries

Because we are genuinely local, we can often respond quicker and more reliably than national call centres or casual operators.

Who Our Same Day Removals Service Is For

Homeowners

When completion dates change at the last minute, you may suddenly need to move the same day. We can quickly organise a suitably sized vehicle and professional team to get you from A to B with minimal stress.

Renters

If a landlord has brought your move-out date forward or your new property becomes available unexpectedly, our same day removals in Streatham help you avoid extra rent or storage costs. We’re used to top-floor flats, narrow stairwells and tight timeframes.

Landlords

We assist landlords who need a property cleared at short notice, whether after tenancy changes, emergency works or last-minute notices. We can remove furniture, boxed items and appliances, and we work with you to meet inventory and check-out times.

Businesses

From small offices to local shops, we help businesses handle urgent relocations, emergency clear-outs and last-minute stock or equipment moves. Our fully insured, uniformed staff work efficiently and respectfully around your team and customers.

Students

Students often face sudden changes to accommodation. We offer cost-effective, flexible same day moves for single rooms, shared flats and halls. We can combine transport with packing help where needed.

What We Can and Cannot Move on the Same Day

Items typically included

- Household furniture (beds, sofas, wardrobes, tables, chairs)

- White goods (fridges, freezers, washing machines – disconnected)

- Personal belongings, clothes, books and boxed items

- IT equipment, office furniture and archive boxes

- TVs, audio systems and standard electronics

- Garage and shed contents (boxed and reasonably portable)

Items generally excluded or needing prior agreement

- Hazardous materials (fuel, gas bottles, chemicals, paint thinners)

- Illegal items or anything that cannot be legally transported

- Unboxed loose small items in excessive quantities

- Very high-value artwork, antiques or specialist items without prior notice

- Large pianos or heavy machinery without a pre-arranged survey

- Live animals or plants in poor condition due to transport

If you are unsure about any particular item, we will clarify during your enquiry so there are no surprises on the day.

Our Same Day Removals Process

1. Enquiry & Quick Quote

Call or message us as early as possible. We ask a few key questions: addresses, property type, floor levels, lift access, approximate volume of items, and your deadline. Based on this, we give you a clear price indication and confirm same day availability where possible.

2. Rapid Survey (Virtual or Onsite)

For most same day moves in Streatham, a short virtual survey (video call or photos) is enough to assess access, parking and item volume. For larger moves and when time allows, we may attend briefly onsite. The aim is to send the right size vehicle and team, avoiding delays and additional costs.

3. Packing & Preparation

Where items are already boxed and furniture is ready, we can load immediately. If you need help packing, we bring professional packing materials and can assist with:

- Boxing loose items

- Wrapping fragile pieces with protective materials

- Disassembling simple furniture such as bed frames

We work quickly but carefully, prioritising fragile and high-value possessions.

4. Loading & Transport

Our trained team uses trolleys, blankets and straps to protect your belongings and property. We plan the load so that items do not shift in transit and fragile pieces are properly secured. Your goods are covered by goods in transit insurance while in our vehicle.

5. Unloading & Placement

At your new property, we unload into the rooms you specify. We can reassemble straightforward furniture and position items where you want them, within the booked time. We always aim to leave you functional and settled the same day.

Transparent Pricing for Same Day Removals in Streatham

Same day removals are priced honestly and transparently. We typically charge based on:

- Vehicle size and number of movers required

- Expected loading, travel and unloading time

- Distance between properties

- Any additional services such as packing or furniture assembly

Urgent or out-of-hours jobs may attract a premium, but we will always explain this clearly before you book. There are no hidden charges for stairs or local congestion unless specifically stated in advance.

Why Choose Professional Removals Over DIY or Casual Man-and-Van?

When you are under time pressure, trying to organise a DIY move or relying on an unvetted man-and-van can quickly become stressful and risky.

- Fully insured: Your belongings are protected by our formal insurance policies.

- Trained teams: We know how to move large, heavy and fragile items safely.

- Proper equipment: Removal blankets, straps, trolleys and tools as standard.

- Reliability: Confirmed booking, arrival windows and a clear process.

- Reduced risk of injury or damage to property.

With Man and Van Streatham, you gain a structured, professional service rather than just a van and a driver.

Insurance and Professional Standards

We take responsibility for your belongings seriously. Our service includes:

- Goods in transit insurance – cover for your items while they are in our vehicle.

- Public liability cover – protection in the unlikely event of damage to third-party property.

- Professional and uniformed teams – experienced movers trained in safe handling.

We follow recognised industry best practice for loading, securing and transporting your possessions. Sensitive items are wrapped and protected as standard, not as an optional extra.

Care, Protection and Sustainability

Even on a same day move, we prioritise care and environmental responsibility.

- Use of reusable removal blankets instead of excessive disposable plastics

- High-quality, recyclable cardboard boxes where packing is required

- Efficient route planning to reduce unnecessary mileage

- Safe lifting techniques to protect both our team and your furniture

We treat every property with respect, protecting floors and walls where needed and ensuring we leave common areas as we found them.

Real-World Uses of Our Same Day Removals Service

Moving House at Short Notice

If your completion date moves suddenly or your buyer or seller brings deadlines forward, we can step in to complete a full or partial house move the same day.

Office or Shop Relocation

Businesses facing urgent lease endings, flood or fire damage, or last-minute fit-out changes often need to move quickly. We can relocate key equipment, furniture and stock to temporary or permanent premises.

Urgent Tenant Moves and Clearances

Landlords and tenants sometimes have to clear a property in a very tight window. We organise quick, orderly removals to meet check-out and handover times, helping to avoid disputes and extra charges.

Frequently Asked Questions

How much does a same day removal in Streatham cost?

Costs depend on the size of your move, access, distance and how much help you need with packing and dismantling furniture. Smaller same day moves within Streatham are usually charged on an hourly rate, with a minimum booking period. Larger house or office moves are often quoted as a fixed price once we understand the volume of items. We will always give you a clear estimate before you commit, and explain any additional charges for late-night work, congestion or parking, so you know exactly what to expect.

Can you always provide same day or urgent availability?

We do our best to accommodate same day requests, especially within Streatham and nearby areas. Availability depends on how busy our schedule is, the size of the move and the time of your enquiry. Calling early in the day increases the chances of securing a slot. Even when we cannot complete a full move the same day, we may be able to move priority items or provide a part-load service. We will always be honest about what can be achieved safely and realistically.

Are my belongings insured during a same day removal?

Yes. Your items are covered by our goods in transit insurance while they are in our vehicle, and our public liability cover protects against accidental damage to third-party property. Insurance applies whether the move is planned weeks ahead or booked the same day, provided we have an accurate description of what we are moving. We still ask that you let us know about any particularly high-value, fragile or unusual items in advance so we can take extra precautions and confirm cover.

What is included in your same day removals service?

Our standard service includes a suitable vehicle, a trained removals team, protective blankets, basic tools for simple furniture dismantling, and loading, transport and unloading to your new address. We place items into the rooms you specify and handle normal staircases within the quote. Optional extras include packing services, supply of boxes and materials, and more complex assembly work. During the initial enquiry, we will run through your requirements so we can include everything you need in a clear, written confirmation.

How is a professional removal different from a basic man-and-van?

A casual man-and-van typically offers transport only, often without formal insurance, equipment or trained staff. A professional removal service like ours provides fully insured vehicles, experienced movers, proper packing and lifting equipment, and a structured process from enquiry to completion. We are accountable for timings, care of your belongings and conduct on-site. That reliability becomes especially important on same day moves, where you have less time to deal with problems or find alternatives if something goes wrong.

How far in advance should I book a same day removal?

For a genuine same day move, contact us as early in the morning as possible. The more notice you can give – even a day or two – the better the chance of securing your preferred time and keeping costs down. However, we understand that many urgent moves cannot be planned. We routinely handle afternoon and evening bookings made earlier the same day, and we will always tell you honestly what we can achieve within your timeframe and budget.

Man and a Van

Man and a Van Streatham – Local, Professional Moving Help

At Man and Van Streatham, our man and a van service is designed for people who want the flexibility of a small move with the standards of a professional removals company. Based in Streatham and working across SW16 and surrounding areas, we handle everything from single-item collections to full flat moves, small house moves and business relocations.

Every job is carried out by a trained, professional team using the right equipment, protective materials and fully insured vehicles, so your belongings are moved safely and efficiently.

What Our Man and a Van Service Includes

Our man and a van service is a flexible option that sits between hiring a van yourself and booking a full-scale removals crew. You get an experienced driver–porter and, where needed, extra movers to handle the lifting, packing support and transport.

Typical service variations

- Single-item moves – sofas, wardrobes, appliances, pianos (upright), artwork

- Flat and apartment moves – studio, 1–2 bedroom properties

- Student moves – halls to home, term-time moves, storage runs

- Small house moves – partial or complete contents for smaller homes

- Office and business moves – desks, chairs, IT equipment, files and stock

- Store collections & deliveries – IKEA, B&Q, Facebook Marketplace, auctions

We plan the job around access, parking, and any time restrictions in Streatham so everything runs smoothly on the day.

Local Expertise in Streatham and Surrounding Areas

Because we operate daily in Streatham, we understand the local streets, parking rules and building layouts. Whether you are moving from a Victorian terrace near Streatham Common, a flat on Streatham High Road, or student accommodation further into South West London, we know the practical challenges and plan for them.

Our local knowledge helps with:

- Arranging suitable parking for the van

- Managing tight staircases and communal entrances

- Working around bus lanes and loading restrictions

- Timing moves to avoid the worst traffic where possible

This local experience means a quicker, calmer move and less risk of delays or damage.

Who Our Man and a Van Service Is For

Homeowners

If you are downsizing, moving a few key items, or clearing a garage or loft, our man and a van service is ideal. We can move bulky furniture, white goods, garden equipment and boxed belongings, all handled carefully and securely.

Renters

Many of our Streatham customers are renters moving between flats or houses. We work efficiently in properties with limited access, communal stairwells and tight time windows, protecting both your items and the landlord’s property as we go.

Landlords

Landlords use us for quick, reliable assistance with furniture removals, end-of-tenancy clearances (non-waste), and delivering or collecting furnishings between properties. We work neatly and respectfully in occupied and vacant rentals.

Businesses

From small offices to local shops, our man and a van service helps with internal moves, office relocations, stock transfers and events. We can move desks, chairs, filing cabinets, boxed archives, display units and light machinery.

Students

Students moving to or from Streatham, or between halls and private accommodation, benefit from a cost-effective, friendly service. We move suitcases, boxes, small furniture, bikes, musical instruments and IT equipment safely and efficiently.

What We Can and Cannot Move

Items typically included

- Household furniture: beds, sofas, wardrobes, tables, drawers

- Appliances: washing machines, fridges, freezers (defrosted), cookers (disconnected)

- Electronics: TVs, computers, monitors, sound systems, gaming equipment

- Personal items: boxes, suitcases, clothes rails, books, kitchenware

- Office items: desks, chairs, filing cabinets, boxed documents, printers

- Outdoor items: garden furniture, tools, bicycles, BBQs (clean and empty)

Items we usually exclude

- Hazardous materials: gas bottles, fuel, paint thinners, chemicals

- Illegal items or anything prohibited by law

- Live animals (including pets and livestock)

- Valuables such as cash, jewellery, important documents – these are best kept with you

- Very large industrial machinery or items exceeding safe lifting limits

If you are unsure whether a particular item can be moved, just ask when you enquire and we will advise or help you find a safe alternative.

How Our Man and a Van Process Works

1. Enquiry & Quote

Contact us by phone, email or online form with the basics: where you are moving from and to, the type of property, approximate list of items, and preferred dates. We will give you a clear, no-obligation quote based on the information you provide.

2. Survey (Virtual or Onsite)

For larger or more complex moves, we may suggest a quick video survey or, if needed, an onsite visit in Streatham. This helps us understand access, parking, stairs or lifts, and get an accurate picture of what needs moving. It allows us to allocate the right van size, team and time.

3. Packing & Preparation

You can pack your own boxes or request help from our team. We can supply packing materials and provide professional packing services for fragile items, kitchenware, artwork and electronics. On the day, we protect furniture with blankets, covers and straps so everything travels securely.

4. Loading & Transport

Our trained movers load the van methodically, securing items to minimise movement in transit. We take particular care with corners, bannisters, lifts and communal spaces. Your goods are then transported directly to your new address in our fully insured vehicles.

5. Unloading & Placement

On arrival, we unload in a structured way and place items in the rooms you specify. We can rebuild basic furniture we dismantled for transport and ensure you are satisfied with the placement before we leave. We take all our protective materials back with us and leave the property tidy.

Transparent Pricing – How We Charge

We believe in clear, honest pricing with no hidden extras. Our man and a van service is usually priced either:

- By the hour for smaller or local jobs

- At a fixed price for clearly defined moves

The price depends on:

- Distance between addresses

- Volume and type of items

- Number of movers needed

- Access (stairs, lifts, long walks, difficult parking)

- Any packing services or materials required

Your quote will state exactly what is included. If your requirements do not change, your price does not change. Any potential additional costs (for example waiting time due to key delays) are explained clearly in advance.

Why Choose a Professional Man and a Van Over DIY

Hiring a van and asking friends might seem cheaper, but it often ends up costing more in time, stress and damage. As a professional removals company, we bring:

- Trained movers who know how to lift safely and protect your belongings

- Appropriate tools and equipment – trolleys, dollies, straps, covers and blankets

- Goods in transit insurance and public liability cover

- Reliable vehicles maintained for removals work

- Efficient planning, so the move is completed quickly and safely

Casual man-and-van operators may not offer proper insurance, written terms, or trained staff. Using a reputable company reduces risk, protects your goods and often makes the whole experience far smoother.

Insurance and Professional Standards

Your belongings are important, both financially and emotionally. We treat them with care and back this up with proper cover and standards:

- Goods in transit insurance – protects your items while they are in our vehicle

- Public liability cover – covers accidental damage to property during the move

- Trained moving teams – staff are experienced in safe handling and loading techniques

- Well-maintained, purpose-equipped vans with protective materials on board

We work to industry best practice, giving you a reliable, accountable service rather than a casual van hire.

Care, Protection and Sustainability

We aim to move your belongings safely while minimising waste and environmental impact.

- Use of reusable transit blankets, furniture covers and straps

- Option to hire reusable crates instead of single-use boxes where practical

- Efficient route planning around Streatham and beyond to reduce unnecessary mileage

- Encouraging customers to recycle or donate unwanted items rather than dispose of them

During every move, we protect floors and walls where needed and handle your items as if they were our own.

Real-World Ways Our Man and a Van Service Helps